Businesses working in the construction industry are required to register the HMRC CIS section.

Payment can be gross or NET

- GROSS - 0%

- NET – 20%

- Unverified – 30%

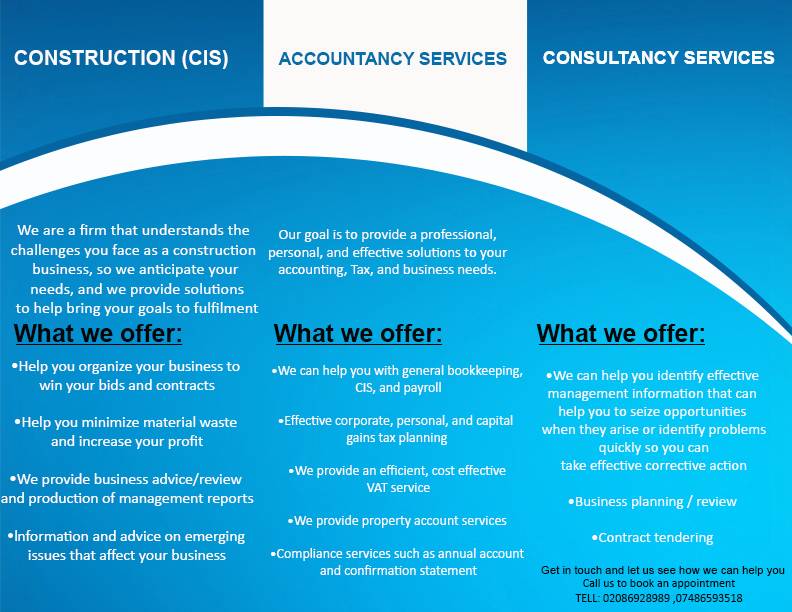

Under the Construction Industry Scheme (CIS), contractors deduct money from subcontractors’ payments, which is then passed onto HM Revenue and Customs (HMRC). The deductions count as advance payments towards the subcontractors’ tax and National Insurance.

We will keep your records and books updated with the latest regulations for your sector and amendments for your interest and will develop a tax plan specially designed for you, that will allow you to save money by minimizing your tax liabilities.

Use the Construction Industry Scheme (CIS) online service

What you must do as a Construction Industry Scheme (CIS) subcontractor